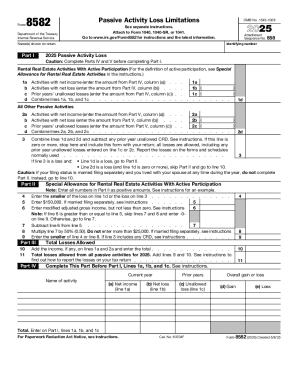

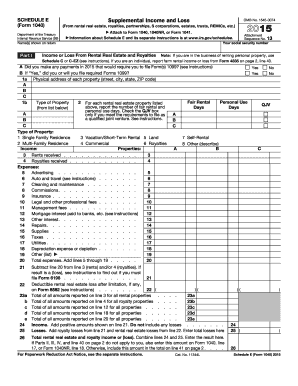

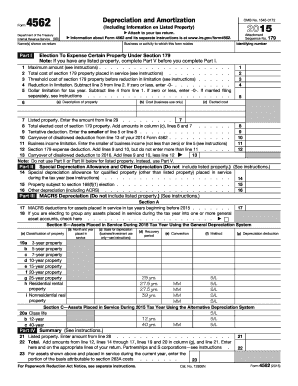

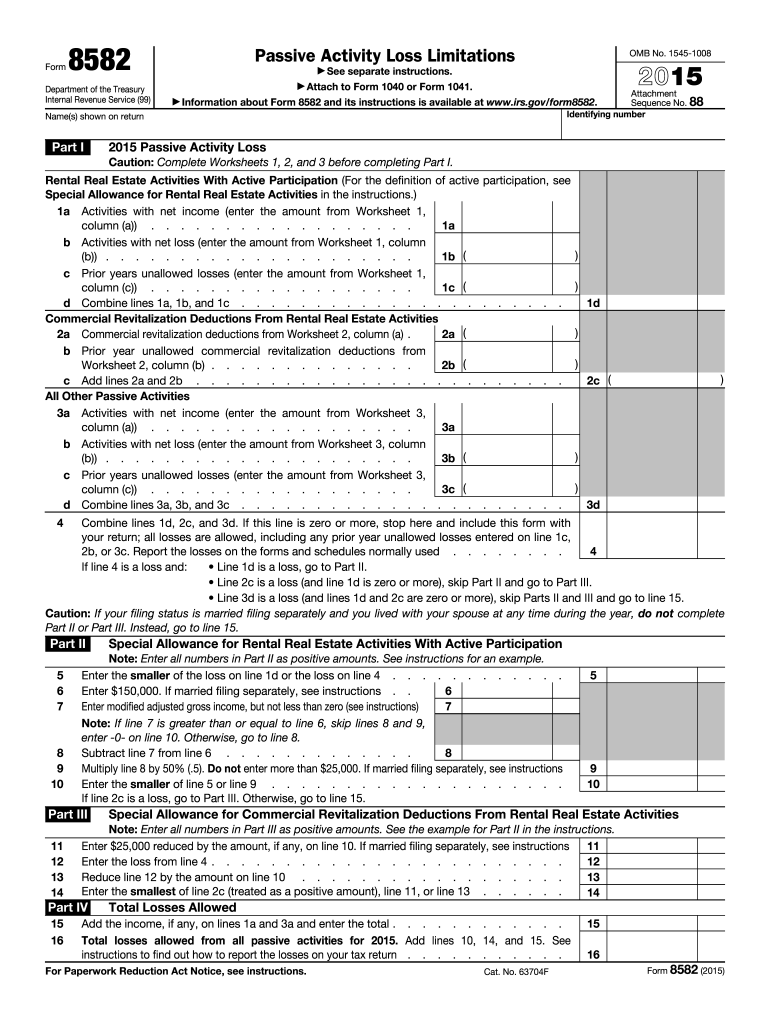

IRS 8582 2015 free printable template

Instructions and Help about IRS 8582

How to edit IRS 8582

How to fill out IRS 8582

About IRS 8 previous version

What is IRS 8582?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8582

What should I do if I discover an error after filing my 2015 8582 form?

If you discover an error after filing your 2015 8582 form, you should file an amended version to correct the mistake. Make sure to clearly indicate that it is a correction and provide all necessary information accurately. This ensures that any discrepancies are resolved promptly and reduces the risk of penalties.

How can I track the status of my filed 2015 8582 form?

To track the status of your filed 2015 8582 form, you can use the IRS online tracking tools available for e-filed submissions. These tools will help verify if your form was received and is being processed. If you encounter any rejection codes, consult the IRS guidelines for troubleshooting common issues related to e-filing.

What should I know about filing the 2015 8582 form on behalf of someone else?

When filing the 2015 8582 form on behalf of someone else, ensure that you have the appropriate power of attorney documentation in place. This helps clarify your authority to act for the individual or entity. Additionally, make sure that all information is accurate and properly reflects the situation of the person for whom you are filing.

What are some common errors to avoid when filing the 2015 8582 form?

Common errors when filing the 2015 8582 form include providing incorrect taxpayer identification numbers and misreporting income amounts. Double-check all numerical entries and ensure that all forms and schedules align correctly with your reported figures. Taking the time to review your submission can help mitigate issues during processing.

See what our users say